The US economy has been expanding wildly for two centuries. Are we witnessing the end of growth? Economist Robert Gordon lays out 4 reasons US growth may be slowing, detailing factors like epidemic debt and growing inequality, which could move the US into a period of stasis we can't innovate our way out of. Be sure to watch the opposing viewpoint from Erik Brynjolfsson.

This talk is about something I've been wondering myself. In 1900 we used horse buggies at 1% of speed of sound. In 1960 we used planes at 90% of speed of sound. But today we're still not supersonic. Has the best growth age passed.

For example: The fastest plane ever, the SR-71 flew 50 years ago. The fastest passenger planes The Concorde and Tu 144 flew in 68/69. If you look at sci-fi films from 1980s predictions for now - they extrapolated growth from 1900 to 1960 (despite two world wars) and came up with predictions for 2000s and 2010s.

(I googled this up, to illustrate my point).

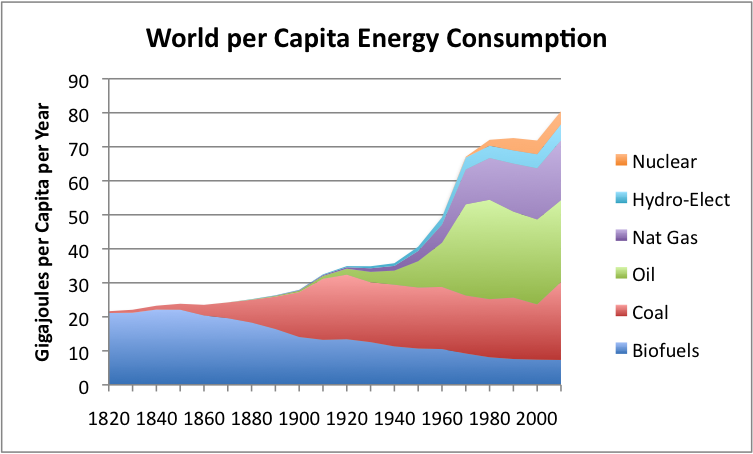

(I googled this up, to illustrate my point).Between 1940 and 1970 energy consumption per capita doubled but hasn't grown as much since then.

I think we're merely maintaining and optimizing our current level of technology and energy. Short of any breakthrough (fusion or other cheap and abundant energy source) economic growth levels will fall from 2-4% to under 1%

Comment